Intel has agreed to sell its memory storage business to SK Hynix for $9 billion (about 10.3 billion won). Intel's memory business includes solid state drives, NAND flash, and a factory in northeast China, all of which will be transferred to the South Korean memory giant in stages through 2025.

The deal was announced in Intel's newsroom early this morning for us Brits and outlines what will be transitioned to the NAND manufacturer over the next few years. Intel's NAND SSD business, including associated employees and IP, will first be transferred to a NAND manufacturing facility in Dalian, China. Thereafter, IP related to NAND flash wafer design and manufacturing, R&D employees, and employees at the Dalian facility will be transferred upon receipt of the final $2 billion in 2025.

Indeed, the Dalian plant employees appear to be collateral for the deal.

Intel will retain the Dalian plant's wafer manufacturing capacity until the transaction is completed in 2025. As such, SK Hynix will provide significant funding, but will not receive the entire business until 2025. Intel will also continue to own the Optane business, which it sold to U.S. memory maker Micron in 2019.

Intel's NAND business represents a total of $2.8 billion in sales for Intel and has contributed $600 million in operating income over the past six months; SK Hynix expects at least $1.2 billion in annual revenue after the deal is completed, but there is still time before that.

The deal is likely intended to help SK Hynix compete with Samsung, the world leader in memory manufacturing. As such, the deal seems to play a bit more into Intel's hands than into those of Korean memory makers.

SK Hynix is down 1.73% in the wake of the deal, but has gradually returned to its previous share price of 86,000-87,000 won.

"We are proud of the NAND memory business Intel has built and believe this combination with SK Hynix will grow the memory ecosystem for the benefit of our customers, partners and employees," said Intel CEO Bob Swan. For Intel, this deal will allow us to play a greater role in the success of our customers and further prioritize investments in differentiated technologies that can deliver attractive returns to shareholders."

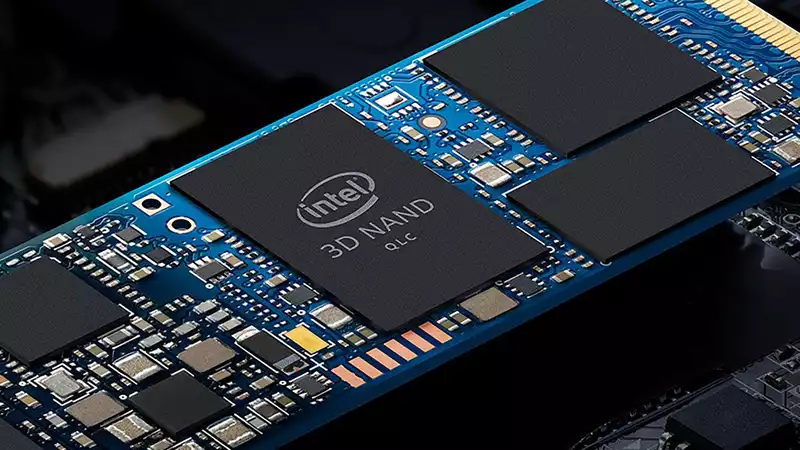

Intel's SSDs have long been among our preferred SSDs for gaming because they have offered the right performance and reliability at their price points, from their high-performance drives to their less expensive QLC drives. Some of the high-performance drives were a bit too expensive for our gaming needs, but their lineup will be sorely missed when SK Hynix disappears from the consumer space.

Many of Intel's high-end drives are built using the company's Optane technology, which has so far been a gradual grasp; the shift in QLC NAND production will be largely overlooked by Intel. In February, the company reported that its Dalian plant had produced 10 million QLC 3D NAND drives to date.

It is worth noting that many of Intel's QLC drives have also been sped up by Optane, so it is unlikely that the exact SSD lineup will remain intact under SK Hynix's watch unless a supply agreement is in place.

With its own lineup of consumer drives like SK Hynix's Gold P31, we expect SK Hynix to have grand plans for Intel's SSDs and to compete for the best gaming SSD guide in the near future. Expectations.

Comments