AMD continues to reap the benefits of its fourth-generation Zen architecture with Zen 3 (following Zen 2, Zen+, and the original Zen), which will go on retail sale on Thursday, November 5. And without tallying a single Ryzen 5000 series unit sold, AMD has gained its highest market share in the CPU market since 2007.

While Intel still dominates, at least in terms of overall market share, AMD's continued rise is reminiscent of the browser wars. There was a time when Internet Explorer once dominated the top spot, but now it has been put out to pasture (replaced by Edge).

This is not an apples-to-apples comparison, of course, and I am not suggesting that Intel follow in IE's footsteps. But it is clear that Intel cannot afford to take its pole position for granted now that AMD is stepping hard on the gas pedal. [According to data the company cited from Mercury Research (via Tom's Hardware), as it stands, AMD's overall x86 CPU share is 22.4%, up 4.1% quarter-over-quarter and 6.3% year-over-year. Not only is the 4.1% QoQ increase impressive, but it also represents AMD's largest market share gain in the past decade.

Profits also came from across the board. Looking at desktop (excluding IoT) x86 CPUs alone, AMD has the highest share of 20.1% since the end of 2013. While Intel still holds the majority of the market, it is worth noting that AMD has increased its share for 12 consecutive quarters. AMD is also likely to extend its consecutive record to 13 quarters with the launch of its Ryzen 5000 series CPUs this week.

In both the notebook and client (both excluding IoT) segments, AMD accounted for 20.2% each. As with desktops, AMD has also increased its market share of CPUs for notebooks for 12 consecutive quarters.

According to Mercury Research president Dean McCarron, AMD's gains are tied to its high-end product offerings.

"Intel's high-end was flat and AMD's high-end grew, while Intel's entry-level business outperformed AMD, so for AMD, 100% of its profits came from the high end. grew so strongly that if market share were limited to just the entry level, Intel would have profited in the third quarter," McCarron told Tom's Hardware.

McCarron further observed that about 60% of AMD's increased desktop shipments were high-end CPUs, with no dual-core chips or APUs, only quad-core and above.

What does this mean? Since market share is fickle, the fact that AMD has consistently captured much of the x86 CPU market is good news for the company and troubling for Intel. At least in the short term.

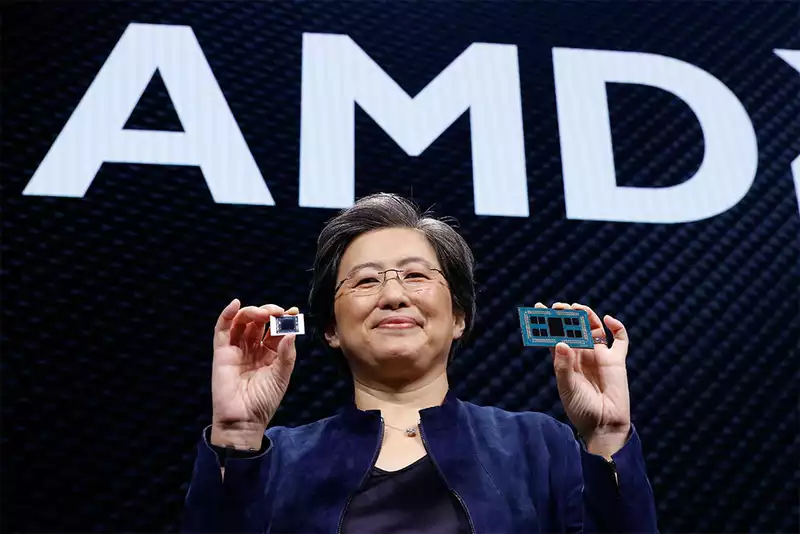

Looking ahead, AMD claims that the IPC (instructions per clock) performance of the Zen 3 CPUs (Ryzen 5000 series) will be 19% better than the Zen 2 (Ryzen 3000 series: desktop) Ryzen 5000 will have virtually expected to give AMD a performance advantage in all categories.

Meanwhile, Intel is set to launch its Rocket Lake CPUs in the first quarter of next year, promising double-digit IPC improvements over Comet Lake. This could put Intel back in front. [Whether AMD and Intel play the leapfrog game in the coming years will depend on how Zen 4 (and beyond) works for the former and the shift to 14nm and beyond for the latter. Either way, as long as AMD and Intel continue to compete for our hearts and minds, the real winners will be us, the consumers.

Comments