Steam's dominance in digital sales of PC games is formidable: in a 2021 survey, more than a quarter of game development studios said they derive more than 50% of their annual revenue from Steam sales. But despite its success, Valve's former economist says the company could have been scarier and more powerful.

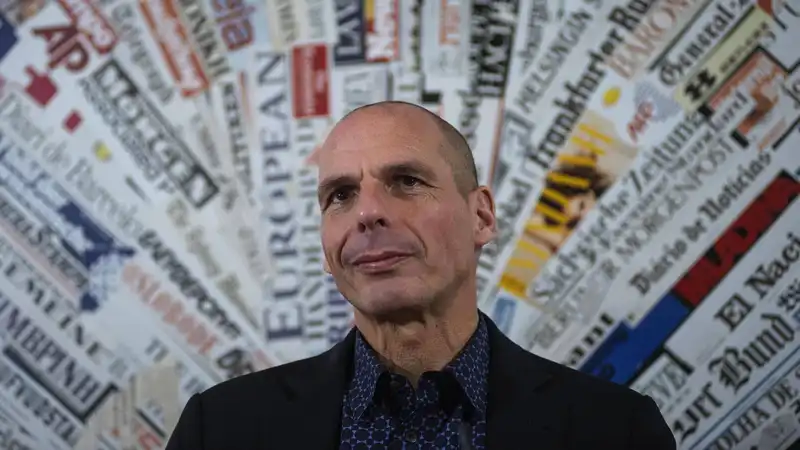

Before serving as Greece's finance minister, Yanis Varoufakis was Valve's resident economist, studying the player economy created by the exchange of in-game goods like TF2 hats. in an interview with Aftermath magazine, Varoufakis said that he never turned his attention away from the game, and that the company's success was a result of its ability to "make money from the game. By not looking away from the game, Balfakis said, Valve was unable to follow its true calling: macroeconomic forecasting

.

Balfakis said that his main job at Valve was to monitor the stability of player markets. By studying how these economies worked, he was able to inform Valve's monetization strategy and avoid the potential mayhem that an unregulated player aftermarket could bring. However, Balfakis said that the economic picture he pieced together left untapped potential.

As Varoufakis describes it, he was using Valve's platform to build a kind of gamified forecasting market, crowdsourcing and ideally researching ways to refine economic forecasting. the Steam user base forms an economy, and that economy is much interconnected with and informed by external economies. Says Varoufakis, "We can use these 100 million people interacting there to essentially improve the predictions of economic forecasters about the U.S. economy, the world economy, interest rates, growth rates, and so on." [For example, he imagined a game of "if you predict next month's inflation rate more accurately than the Fed, you get brownie points or credit points. Although Varoufakis does not explicitly say so in the interview, one can readily imagine that he might have contributed to a rating system in which contributors who made accurate predictions were given a higher weighting, gradually producing more accurate predictions.

"If that had happened, Valve would have been able to produce better macroeconomic forecasts for the U.S. economy and the world economy than [the International Monetary Fund or] Goldman Sachs," said Varoufakis.

Imagining an alternate timeline in which Valve becomes the lynchpin of a global investment bank seems like a dystopian nightmare to me, but Varoufakis told Aftermath that because Valve is a myopic company focused on games, hat economy He said it has become "less interesting" than it was in its heyday. For Varoufakis, Valve had fallen prey to the poison of selling too much junk.

"Commoditization won," Varoufakis said. There was an important value there that commoditization destroyed."

Comments