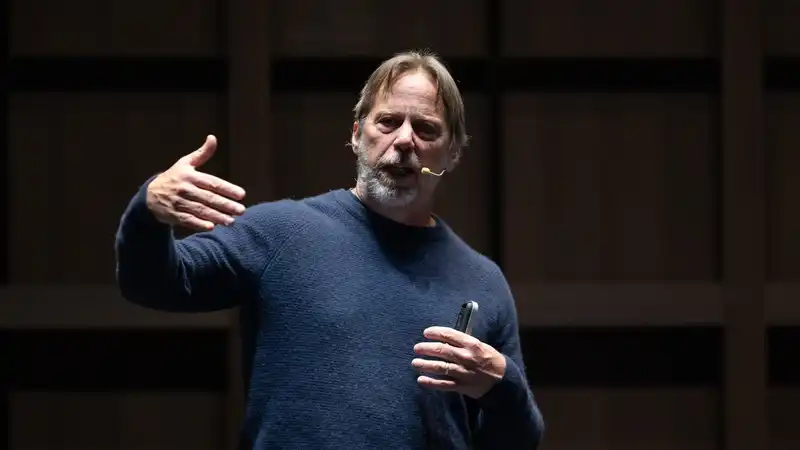

Nothing is more certain than that Jim Keller, former AMD and Tesla engineer and now CEO of AI computer company Tenstorrent, will make bold claims in public. But there is at least one thing more certain than this. That is that Nvidia is firmly established as the king of AI hardware. Combining these two certainties, Keller stated in a recent DemystifySci podcast that "Nvidia is slowly becoming the IBM of the AI era."

According to Keller, when it comes to AI, Nvidia now has "the best processors by functionality and obvious demonstration points," which means that "all the big tech companies are in an arms race and calling Nvidia to get new AI processor assignments . are calling Nvidia to get new AI processor allocations." At the very least, this is a solid fact.

The explosive AI market of 2024 portends a brave new world for technologists. One does not need the obsessive and wacky techno-optimism of futurist Kurzweil to understand this. Nor does one need Keller's industry experience to see the enormity of Nvidia. The numbers speak for themselves. For example, Nvidia earned more than $26 billion in the first quarter of 2024, of which more than $22 billion came from AI data center demand. Nvidia CEO Jensen Huang has also stated that AI constitutes the "next industrial revolution" with Nvidia at the center.

Nvidia's foresight in shifting its focus to AI early on, coupled with its already well-developed infrastructure, puts Nvidia in a prime position to dominate the AI market No other chip foundry can meet the demand like Nvidia. And with big companies like Microsoft, OpenAI, and Meta wanting a slice of the fast-growing but not yet there AI pie, Keller is right that Nvidia could become to AI what IBM was to computers a few decades ago There is good reason to believe that Nvidia has the potential to become to AI what IBM was to computers decades ago.

After dominating the enterprise mainframe market, IBM created the personal computer in the 1980s, and for a while it was the only real game in the PC world; when people said "PC," they meant IBM. Keller seems to have that in mind when he talks about NVIDIA and AI.

Putting aside the obvious concerns about monopolies, if we follow Keller's analogy, let's not forget what happened to IBM in the 1990s and early 2000s: IBM's PC dominance was short-lived, thanks in part to its own decisions. Microsoft created an operating system for the IBM PC and allowed IBM to sell the MS-DOS OS to other companies: companies began to associate "PC" with Microsoft.

Now, I'm not saying that the same fate awaits NVIDIA, but we must remember that monopolistic markets rarely stay that way.

This is even more important to remember in an incredibly new market like AI. Whatever the outcome, there are already indications that the AI data center market is built on a slippery foundation.

Sequoia analyst David Cahn (via Tom's Hardware) has stated that it would take about $600 billion in annual revenue to cover the cost of AI infrastructure built by AI companies, making even optimistic projections impossible. This could imply (or scream) the growth of a financial bubble that no one wants to see burst.

But at the risk of sounding like a broken record, the AI market is new. It is a completely freshly created new market. And if AI is to usher in the next industrial revolution, it cannot preclude the changes and innovations that will bring the necessary revenue to AI companies.

In this case, if NVIDIA had the foresight to enter the booming AI chip manufacturing market before anyone else, maybe it also had the foresight to grow a terrifying bubble filled with unexpected revenue-generating innovation.

Or maybe Keller's IBM statement is more prescient than he realizes. We will find out in due course.

Comments