10 years ago, Nvidia was a successful graphics card company, with a market capitalization ofド100 billion, which was very impressive. Now, driven by the tech world's desire to inject AI into everything and everyone, thanks to huge revenues and profits, Nvidia's share price has reached a staggering three trillion dollars more than apple, Google and Amazon.

Only microsoft has a larger market cap, but the margins between it, Nvidia, and Apple are all very narrow. Well, if 1 could be called tens of billions of dollars narrow."For those unfamiliar with the term market capitalization, it's a relative measure of how valuable a company is in the stock market, a figure determined by a simple multiplication of the number of shares of a company and its current share price.

At the time of writing, Microsoft's shares are selling for aboutま420, while Apple's shares are about half that. Nvidia, however, is now considered so valuable that buying only one of its shares will set you back over 1,200. It's almost enough to buy the best graphics card, the GeForce RTX4090, but it's still as short as4400.

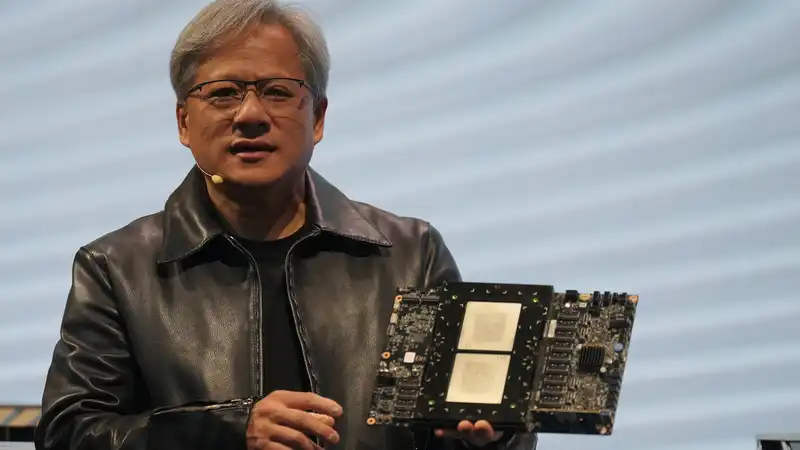

And it all depends on the fact that tech companies don't get enough of Nvidia's superchips, such as the Hopper H100 and the recently launched Blackwell range. These are huge, expensive processors designed to handle the billions of calculations required for AI training and inference (or, in some cases, multiple processes).These products do not have retail prices, but they are looking at numbers 20 times higher than RTX4090, and companies such as Meta, OpenAI and X are buying hundreds of thousands of products. That's why Nvidia's data center division's revenue has soared, generatingド3 billion over the past 225 months, 10 times more than its gaming division. But, as AMD tells you, it's not just revenue. In Q1 of this year, it made more thanま5.5 billion in revenue, but net profit was onlyま10 billion. Over the same period, Nvidia's net profit was less than収益260 billion from revenue of1150 billion. It's not hard to see why stock prices have risen so quickly.

Profit is not the only reason Nvidia is currently considered the 2nd most valuable company in the world. It also explains the fact that at the moment there is no other business that can produce as many AI megachips as Nvidia, with the complete software stack and performance that customers demand. TSMC is a chipmaker contracted to manufacture all of Nvidia's Hopper and Blackwell processors, and also cannot make enough to meet demand.

That demand shows no sign of tailing any time soon, even though AMD and Intel are pushing their own giant chips. Amazon and Google produce AI processors to suit their own needs, but OpenAI, Microsoft, Meta, Tesla and X aren't, and they're all knocking on the door of Nvidia's products.

Currently, Microsoft has the highest market capitalization of any company —ド620 trillion - with massive revenue (収益220 billion in revenue last quarter,純利益3.15 billion in net profit) and throwing everything it can into AI. From Copilot+Pc to the privacy recall, Microsoft wants AI to be an important part of every bit of software it churns out.

And, as we saw at Computex2024, the majority of ancillary tech companies and hardware vendors are keen on Microsoft's tail, sticking AI to motherboards, graphics cards, SSDs, and even power units, even though few actually use AI. This is not to dismiss the use of machine learning because the game has clear applications and benefits, but because of the neural network the PSU's

Artificial intelligence may not be making a big difference to your life at the moment, but for Nvidia, it's likely to be the most valuable company in the world.

.

Comments