Nvidia has revealed that its CMP (cryptocurrency mining processor) lineup is on track to generate more revenue than originally expected, at the same time that it announced a bleak outlook for this year's GPU shortage.

From the CMP lineup launched last month, Nvidia initially expected to generate $50 million in revenue. However, in a short period of time, the company tripled that figure to $150 million.

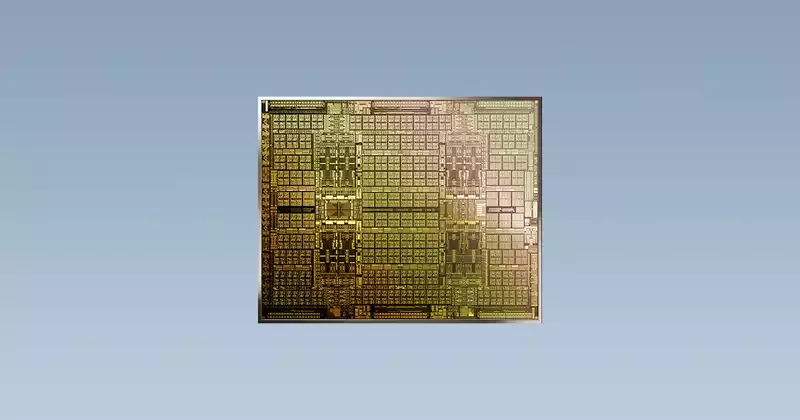

Nvidia's CMP lineup consists of four cards and has some similarities with Nvidia's existing and past GeForce generations. However, they are not identical. While they may share some silicon, the CMP cards are reportedly built on GPUs that cannot provide what Nvidia's GeForce lineup needs. It also has no output and probably costs more.

A large cryptocurrency company recently placed an order for $30 million in CMP GPUs, which represents a fairly large percentage of Nvidia's new CMP revenue alone. This is a fairly large percentage of Nvidia's new CMP revenue alone. Scale seems to take precedence over savings here, and order values could be in the thousands of dollars for Ampere and Turing chips. Some of the larger mining operators are looking for higher hash rates while the value of cryptocurrencies is rising, and they seem willing to pay extra for it.

Nvidia may be one of the few companies in the world with the ability to supply a significant number of GPUs to a single customer. Nevertheless, the company expects demand to strain GPU supply throughout 2021.

GPUs that fit the company's CMP cards are also likely to end up in short supply, either by accident or being rebuilt from previous generations. Ampere chip yields should improve over time, and Turing chip backstock will certainly slim down without investment.

I expect Nvidia to be hesitant to commit because of the inventory oversupply problem in the former cryptocurrency boom and bust; Nvidia lost a lot of stock value in 2018, largely due to oversupply, and may be cautious about falling into the same trap again We think it is.

There was some debate about whether these mining-specific SKUs would sell that well given the lack of resale value. However, the desire for volume from large mining companies and their appeal to the large amounts of cash being dropped into GPU shipments seems to have largely negated that concern; Nvidia, as mentioned in a recent announcement, is aiming for an "industrial-scale" mining business, and if the cryptocurrency crashes, they will be able to use the used cards, not targeting small businesses looking to profit from shifting cards.

Comments